Jane Jacobs, in “The Death and Life of Great American Cities,” famously identified the vital signs of a healthy city. One of her simple ideas with profound consequences is the following:

Old ideas can sometimes use new buildings. New ideas must use old buildings.

Jacobs' observation was that, in a vibrant city, city blocks “must mingle buildings that vary in age and condition, including a good proportion of old ones.” Jacobs points out that the types of companies that can afford newly constructed spaces are invariably chain stores, banks and chain restaurants, because they can afford the high capital costs associated with new construction. But startup companies, the companies that will produce future growth of the city, these must make do with older spaces. If you eliminate all the older spaces, you also eliminate the potential for future growth.

What is remarkable about Jacobs’ book is that it presents an economic argument for tempering the speed of development. She doesn’t argue that cities should pace construction for nostalgic reasons, e.g. to preserve some idea of the city of the past. Instead, she makes point after point of sound economic sense why cities must avoid the temptation to raze and build.

There are numerous ways to achieve a healthy balance of development in a city. A comprehensive review process is one. Leveraging a tax on developers who buy and flip a building in less than five years is another. The goal is to dissuade developers looking for a fast buck, while encouraging developers who think in longer terms about investing in a community.

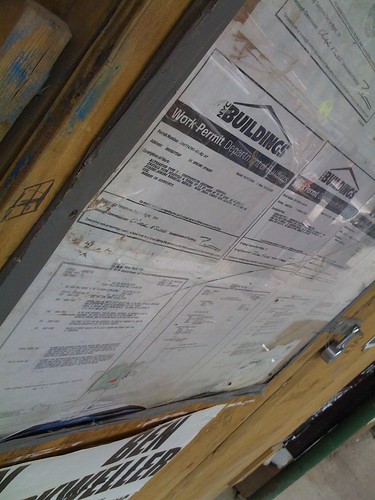

Politicians, however, rarely argue for this model of development. Major Bloomberg, well known for his developer-friendly stance, took the opposite tack. During his tenure, Bloomberg doubled the size of the Department of Buildings, which grants building permits. At the same time, he reduced the budget to the city community boards, which review building permit applications. The result was a huge increase in the volume of building permits, with less oversight from the communities that were being developed.

By eliminating barriers to development, Bloomberg achieved his goal of massively expanding construction in the city. For a while, it seemed that every block in Manhattan had at least one building project underway. Many developers saw this as their chance to get rich: buy a building, fast-track a permit, do a demo or gut reno, flip it in eighteen months as luxury condos, and make a huge profit.

The results of this recipe for quick money are now clear. While we have had an unprecedented level of construction of new buildings since Bloomberg came to office, they are not the buildings the city needs. In the economic downturn, we now face a massive glut of unsold luxury condos, unrented newly built storefronts, and stalled building projects that may never reach completion. Meanwhile the city needs affordable apartments, low-rent commercial spaces suitable for new business growth, and hospitals and schools - in short, incentives to keep New York's middle class in the city, something the city is failing to do, according the a report by the Center for an Urban Future published in February.

Jane Jacobs’ book easily predicted the current situation. In what must be economics lesson 101, she argues throughout the book that cities must above all preserve diversity. Diversity is what gives the city its strength in times of crises and rapid change.

Bloomberg argues that he is running for a third term as major because this gives New Yorkers more choice in the election, and it gives us the choice of electing a financially knowledgeable manager.

The New York Times reports today that political opponents are dropping out of the race left and right, because they view Bloomberg’s $80 million campaign war chest as unbeatable. Just as he reduced the diversity of the city’s stock of buildings, Bloomberg is now doing the same for the pool of candidates running for mayoral office. For a man who claims to have economic wisdom, Bloomberg is surprisingly forgetful of his Economics 101.

I hold Bloomberg largely responsible for the city’s unfettered development of buildings for the ultra-rich, and the consequent housing bubble. He will not receive my vote.

No comments:

Post a Comment